Missiles, Cash, Men: Who Hits the Jackpot in Ukraine?

(Eastern Post – London, October 2025)

When war stops being only a battlefield and becomes a stable economic practice, it doomfully takes the form of a market. On the frontline remain people with call signs — “Схiд”, “Дэнди” — and their everyday calculation: who will remain tomorrow. Above them — a chain of contracts, factory shifts, bank guarantees and corporate quarterly reports. This chain is not illusory; it is measurable. In the reports of the largest defense corporations it is visible not only the line “revenue”, but also the trace left by new orders, accelerated repair programs and long-term backlogs, which form a solid financial interest to the duration of the conflict. War creates systemic demand. Demand gives birth to long-term contracts. Contracts fix production capacities. Capacities require financing. Financing forms stable profit. Duration of conflict → increase of capitalization of the industry. So, Lockheed Martin fixed in 2023 year net sales of about $67.6 billion and increased them to $71.0 billion in 2024 year — a sum which reflects the scale of operations on production of aviation and missile technique and servicing of the armament fleet.

Analogous picture and in the structures united now under the brand RTX (former Raytheon Technologies): the revenue of the corporation has grown and in 2024 year exceeded $80 billion, supported by demand on missile complexes, air defense systems and ammunition, and also service contracts which became for the industry a source of regular income. Northrop Grumman and General Dynamics demonstrate revenues in tens of billions: at Northrop Grumman the total sales in 2023 year amounted about $39.3 billion, at General Dynamics — about $42.3 billion for the same period; these sums reflect demand on reconnaissance systems, ground armored technique, shipbuilding and logistics, without which modern war does not get along.

Boeing, with its defense “branches” — Defense, Space & Security — is an important part of the general portfolio, in 2024 year showed a decrease of the total yearly revenue of the group, but at the same time the subdivisions connected with defense and services remain a source of significant contracts and multibillion obligations on development and deliveries of air defense systems and components. This illustrates one more important economic principle: the corporate portfolio diversifies, but the flow of means into the defense sector remains systemic and predictable. According to the data of SIPRI, the total revenue of the American military-industrial complex for the last two years increased contrary to the general recessionary trends of the world economy:

— growth of demand on missiles, air defense and unmanned aerial vehicles,

— record backlogs,

— ahead-of-time financing of R&D.

War becomes a driver of industrial growth, especially in the sectors where turnover of capital accelerates through state guarantees.

For Russia an equivalent role is played by the state-corporate conglomerate. The state corporation “Ростех” in 2023 year declared revenue of about 2.9 trillion rubles, a significant part of which came on fulfillment of the state defense order and the increased output of armored technique, Multiple Launch Rocket Systems (MLRS) and ammunition. In ruble expression this looks like a large-scale redistribution of national income in favor of the military-industrial bundles.

These figures by themselves do not prove the cause-and-effect connection “every shot — a dividend”, but they demonstrate the economic logic: conflict gives birth to demand on production and services of defense, long-term orders convert into growth of revenue and strengthening of production capacities, and financial institutes create infrastructure of crediting and insurance, supporting this ecosystem. International statistics confirms the general trend: the total incomes of the hundred largest producers of armament in 2023 year grew and reached hundreds of billions of dollars, and the export of military technique from the USA in 2024 year — record volumes of about $318.7 billion — serves as a macroeconomic marker of the growing world demand on armament.

In practical measurement this means the following. When the political decision is translated into real actions — introduction of troops, escalation, refusal from negotiations — the market receives a clear signal of demand. Producers expand lines, subcontractors launch new shifts, banks arrange guarantee lines, factoring schemes accelerate turnover of means. For the final holder of shares this flows out into a report about growth of sales, for management — into the fulfillment of the quarterly plan, and for the government — into satisfaction of short-term tasks of security. Meanwhile for the soldier and for the citizen these processes are measured by losses and deprivations. One and the same machine — political and economic — is perceived by the participant of the frontline as a source of endless expenditure of human life, and for the corporate account it means a stable flow of revenue and strengthened ordered backlog.

It is impossible not to note also the transformation of the structure of benefit: benefit is received not only by the producers of “iron”, but also by the service players — companies on repair and logistics, contractors on training and cyber-reconnaissance, companies ensuring satellite and unmanned infrastructure, and also financial intermediaries which structure deals and cover risks. SIPRI and industry analysts directly indicate that in the last years the growth of revenue of the largest producers and suppliers is conditioned exactly by the combined demand on ammunition, air defense, unmanned aerial vehicles and repair-service services. Every new month of the conflict converts into new volumes of orders and growth of future profit. At the shareholders — dividends, at the management — bonuses for fulfillment of KPI, at the banks — guaranteed interests on credit lines of defense contractors.

Decrease of tension means reduction of turnover. In this hidden paradox arises the economic interest to prolongation of war. This economic reality puts before society a principal question about mechanisms of control and responsibility. Public rhetoric appeals to patriotism and security; accounting lines appeal to efficiency and long-term obligations. Between these appeals hides commercial calculation: while the market of armament remains non-transparent and tied to state budgets, it will reproduce the interest to maintenance of demand. To change this is possible only politically and institutionally: through transparency of contracts, through public control over distribution of budgets and through international mechanisms which could limit the commercial conversion of conflicts into stable profit.

Finally, it should be underlined the ethical metric: when human life becomes a resource, attention to its price is governed not only by state strategies, but also by the algorithms of corporate reporting. An English journalist and a German thinker could note that objectively the historical reality appears in material relations; today these relations look so that financial profit and military activity have become mutually reinforcing categories. While this is not recognized and not put under public control, war will preserve its gain-receivers — from the largest corporations and banks to national producers and state contractors, each in its own currency and in its own way brings a digit into the account of human loss.

(Data are used from public annual reports of Lockheed Martin, RTX (Raytheon), General Dynamics, Northrop Grumman, Boeing, from the reports of SIPRI and from public messages of “Ростех” about financial results for 2023 year.)

P.S. — international profit figures

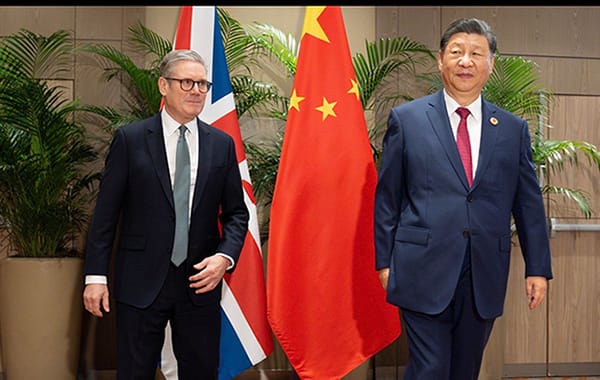

BAE Systems (United Kingdom) for the financial year ended 31 December 2024: revenue £26.312 million (growth +14 % relative to 2023) and order backlog about £77.8 billion.

Rheinmetall AG (Germany) for 2024: consolidated sales €9.75 billion (+36 % year to year) and new record order backlog €55 billion.

Rostec Consolidated revenue of the corporation in 2024 grew by 27 % in relation to 2023 and amounted to ≈ ₽3.61 trillion (£34.15 billion). Net profit of the corporation in 2024 grew by 119 % and amounted to ≈ ₽131.5 billion (£1.24 billion). In May 2025 the head of the corporation Chemezov reported to the President of the Russian Federation that the revenue will only grow.

Editorial EasternPost

Publisher: The Eastern Post, London-Paris, United Kingdom-France, 2025.